Understanding the 2025 Social Security COLA Increase

The Social Security Cost-of-Living Adjustment (COLA) is an annual increase in benefits designed to help seniors and people with disabilities keep pace with inflation. The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures the change in prices of goods and services commonly purchased by urban wage earners and clerical workers.

Factors Determining the COLA, 2025 social security cola increase

The COLA is determined by the percentage increase in the CPI-W from the third quarter of the previous year to the third quarter of the current year. The increase is calculated using the following formula:

(CPI-W for the third quarter of the current year) – (CPI-W for the third quarter of the previous year) / (CPI-W for the third quarter of the previous year) * 100

This formula calculates the percentage change in the CPI-W over the specified period, which then determines the COLA for the upcoming year.

Projected Inflation Rate for 2025 and its Potential Impact on the COLA

The projected inflation rate for 2025 is uncertain, but economists predict it will remain above the historical average. The Federal Reserve aims to bring inflation down to its target of 2%, but achieving this goal is complex. Higher inflation rates typically result in larger COLA increases. For example, if inflation is 3% in 2025, Social Security benefits could increase by 3%.

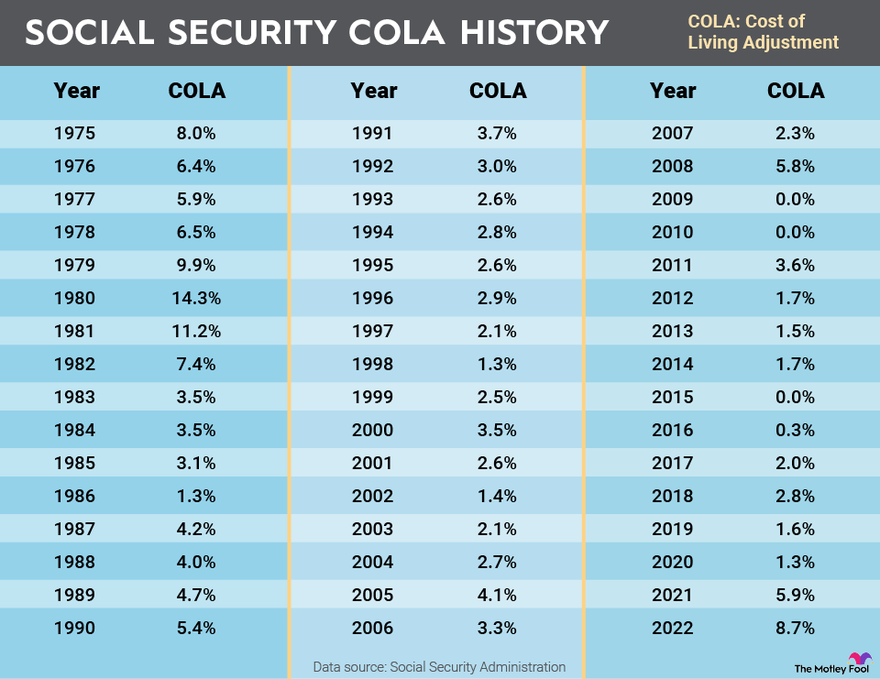

Historical Trend of COLA Increases in Recent Years

The COLA has varied in recent years, reflecting changes in inflation. Here’s a table illustrating the COLA increases for the past five years:

| Year | COLA Increase |

|—|—|

| 2023 | 8.7% |

| 2022 | 5.9% |

| 2021 | 1.3% |

| 2020 | 1.6% |

| 2019 | 2.8% |

As you can see, the COLA has been higher in recent years due to rising inflation. However, it’s important to note that the COLA does not always fully offset inflation. In some years, the COLA may be lower than the actual inflation rate, resulting in a decline in the purchasing power of Social Security benefits.

Impact of the COLA Increase on Beneficiaries: 2025 Social Security Cola Increase

The projected COLA increase for 2025 will have a significant impact on Social Security beneficiaries, influencing their financial well-being and the sustainability of the Social Security trust fund.

Financial Implications for Different Beneficiary Categories

The COLA increase will directly affect the monthly benefits received by Social Security recipients. The amount of the increase will vary depending on the individual’s benefit amount. For instance, a beneficiary receiving $1,500 per month will see a larger increase in their monthly benefit than someone receiving $1,000.

The COLA increase will have a particularly significant impact on low-income beneficiaries, as the increase represents a larger percentage of their total income. This can help to alleviate financial strain and improve their standard of living. For higher-income beneficiaries, the impact may be less pronounced, but it can still provide some financial relief.

Impact of the COLA Increase on Purchasing Power

The COLA increase is intended to help Social Security beneficiaries maintain their purchasing power in the face of inflation. However, the effectiveness of the COLA in achieving this goal can vary depending on the actual inflation rate and the specific goods and services that beneficiaries need to purchase.

If the COLA increase is lower than the actual inflation rate, beneficiaries may experience a decline in their purchasing power. Conversely, if the COLA increase exceeds the inflation rate, beneficiaries may experience an increase in their purchasing power.

Potential Impact of the COLA Increase on the Social Security Trust Fund

The COLA increase will also have an impact on the Social Security trust fund. The trust fund is funded by payroll taxes and is used to pay benefits to current retirees.

The COLA increase will increase the amount of money that the Social Security Administration needs to pay out in benefits.

This could potentially lead to a faster depletion of the trust fund, especially if the COLA increase is substantial and the trust fund is already facing financial challenges. However, it is important to note that the trust fund is projected to be depleted in the coming decades, regardless of the COLA increase.

Policy Implications and Future Projections

The 2025 Social Security COLA increase is a significant event, but it’s crucial to consider its implications for the long-term sustainability of the program and the potential for future adjustments. Understanding these factors helps beneficiaries and policymakers alike navigate the evolving landscape of Social Security.

Potential Policy Changes Impacting Future COLA Increases

Policy changes can significantly influence the future of COLA increases. Here are some potential areas of focus:

- Changes in the COLA Calculation Formula: The current formula, based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), has been criticized for not accurately reflecting the spending patterns of retirees. Policymakers may consider revising the formula to better account for the unique expenses of older adults, such as healthcare costs. This could lead to higher or lower COLA increases in the future.

- Means Testing: Means testing involves adjusting benefits based on income. Implementing means testing for Social Security could lead to lower COLA increases for higher-income beneficiaries, potentially impacting the program’s distribution of benefits.

- Changes in Retirement Age: Raising the full retirement age could affect the long-term solvency of the program by reducing the number of years beneficiaries receive benefits. This change could also influence the timing and amount of COLA increases.

Long-Term Sustainability of the Social Security Program

The long-term sustainability of Social Security is a complex issue influenced by several factors, including:

- Demographic Trends: The increasing life expectancy and declining birth rate contribute to a growing ratio of retirees to workers, putting pressure on the Social Security system.

- Economic Factors: Economic downturns can impact payroll tax revenues, which fund Social Security.

- Political Considerations: Political decisions regarding program funding and benefit levels significantly influence the program’s sustainability.

Projection of Future COLA Increases

Predicting future COLA increases with certainty is impossible. However, based on current trends and economic projections, here are some potential scenarios:

- Moderate Inflation: If inflation remains moderate, future COLA increases may be in line with historical averages, ranging from 2% to 3% annually.

- Higher Inflation: If inflation rises significantly, COLA increases could be higher to maintain the purchasing power of benefits.

- Economic Recession: A recession could lead to lower inflation and potentially lower COLA increases.

2025 social security cola increase – The 2025 Social Security cost-of-living adjustment (COLA) is a topic of great interest for many, especially those relying on the program for their income. While we await the official announcement, it’s a reminder that even in times of uncertainty, individuals like alex highsmith , who’s proving himself to be a formidable force on the Pittsburgh Steelers, are working hard to secure their futures.

Just as Alex is making his mark on the field, the 2025 COLA will undoubtedly impact the lives of countless Americans, providing a much-needed boost for many families.

The future of Social Security benefits is always a source of anxiety for millions of Americans. The upcoming 2025 cost-of-living adjustment (COLA) is especially important, as it will determine the size of your monthly check for the entire year.

To learn more about what factors will influence the 2025 Social Security COLA increase, check out this informative article 2025 social security cola increase. Understanding the details of the COLA calculation can help you plan for the future and ensure you receive the support you need.